Non-Resident Importers

Non-Resident Importers

Non-Resident Importers (NRI)

Non-resident importers (NRI) and resident importers share the same rules, regulations, rights and responsibilities concerning Canada Customs.

As the name suggests, non-resident importers (NRI) are companies that may not have a physical presence in Canada, but nevertheless have undertaken the responsibility for the customs accounting process, including payment of any duties and taxes owing. J.B. Ellis is an industry leader providing non-resident importers with the kind of assistance they need to enhance their business opportunities in Canada.

Now you can ship your product direct to your customers in Canada – hassle free!

The NRI program allows you to have full control over the supply chain – no distributor needed – so your product can reach your Canadian customers faster than ever before.

Features

- Increase sales into Canada through direct marketing

- Manage your delivered pricing

- Streamline your customs documentation

- Remove the idea of the “border” for your customers

- Canadian customers will have access to your full product line

Features

- Increase sales into Canada through direct marketing

- Manage your delivered pricing

- Streamline your Customs documentation

- Remove the idea of the “border” for your customers

- Canadian customers will have access to your full product line

Features

- Increase sales into Canada through direct marketing

- Manage your delivered pricing

- Streamline your customs documentation

- Remove the idea of the “border” for your customers

- Canadian customers will have access to your full product line

Benefits

- No need to have a physical presence in Canada

- Streamlined door-to-door delivery

- Customers purchase goods for a single “all-in” price, no more surprise costs upon delivery

- Complete control over the supply chain, customs process, and shipping expenses with a single source Broker contact

- Access a greater share of the Canadian market

Benefits

- No need to have a physical presence in Canada

- Streamlined door-to-door delivery

- Customers purchase goods for a single “all-in” price, no more surprise costs upon delivery

- Complete control over the supply chain, customs process, and shipping expenses with a single source Broker contact

- Access a greater share of the Canadian market

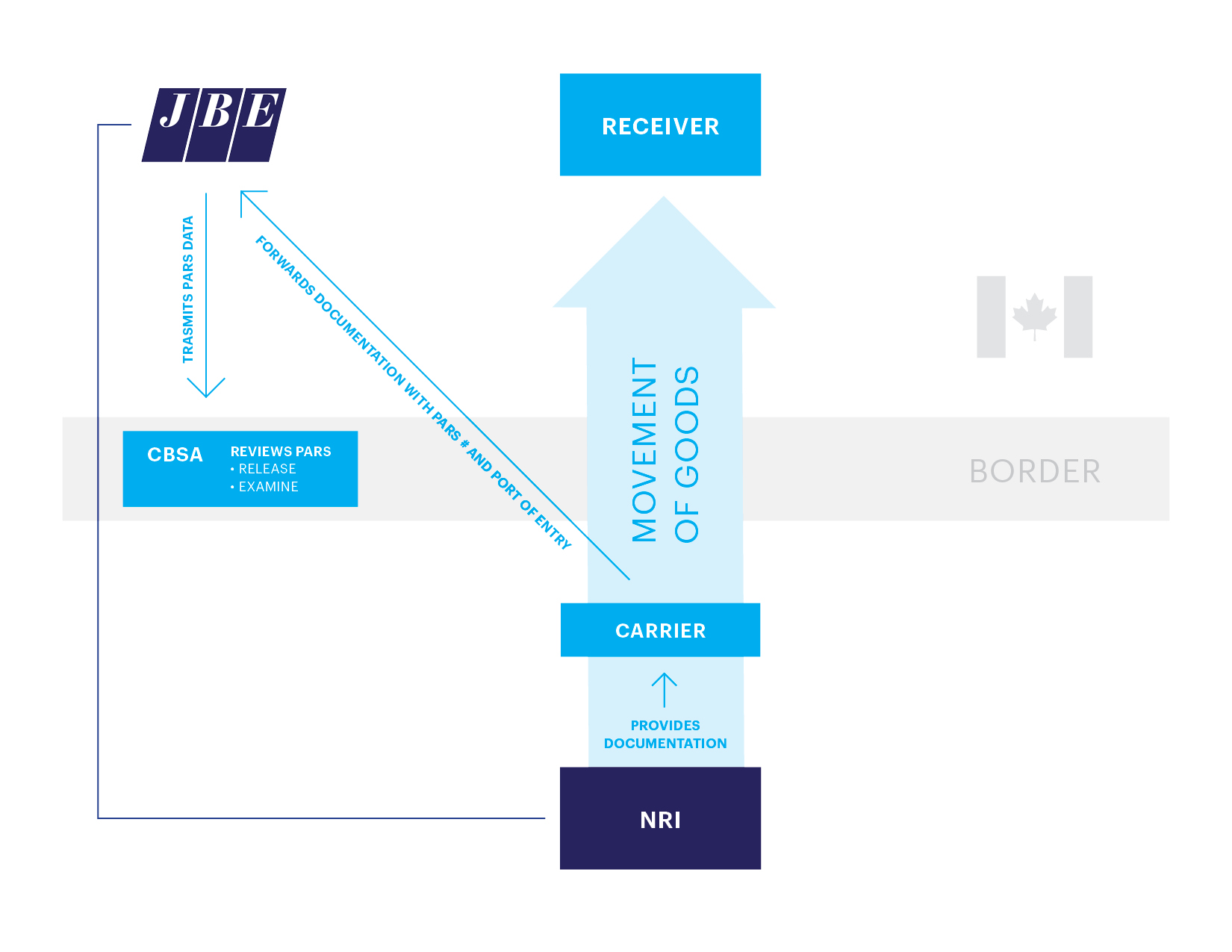

How it works

- The NRI (vendor) receives order information from the Canadian customer

- The customer is invoiced and a commercial carrier is hired to ship the ordered goods to Canada

- J.B. Ellis receives the shipment data/documentation and transmits this information (PARS) to the Canadian Border Services Agency (CBSA)

- The CBSA officer will acknowledge receipt of all release data elements, and provide confirmation in the form of a PARS accepted message - all while the shipment is enroute to Canada

- On arrival at the border, the CBSA officer makes a release/examination decision

- Once released by CBSA, the goods are delivered and J.B. Ellis accounts for any applicable duties and taxes with CBSA on behalf of the NRI

The customer will find their purchase as easy as buying domestically.

© J.B. Ellis & Co. Ltd. All rights are reserved